Market Peaks: Navigating the Crest of the Financial Wave!

As we get deep into the discussion about market trends and analytics, an important topic often broached is whether a given market appears to be toppy. To many, this may seem to be filled with jargon and financial complexities. Nonetheless, understanding the concept of a toppy market is vital for investors and market analysts.

A toppy market refers to a situation where the prices of securities have surged magnificently and are about to reach the peak, after which they are likely to decline. These markets are typically characterized by an extended period of rising prices and increased buying activities, leading to extraordinarily high-security prices. However, these soaring prices are usually not sustainable over an extended period, hence the eventual anticipated decline.

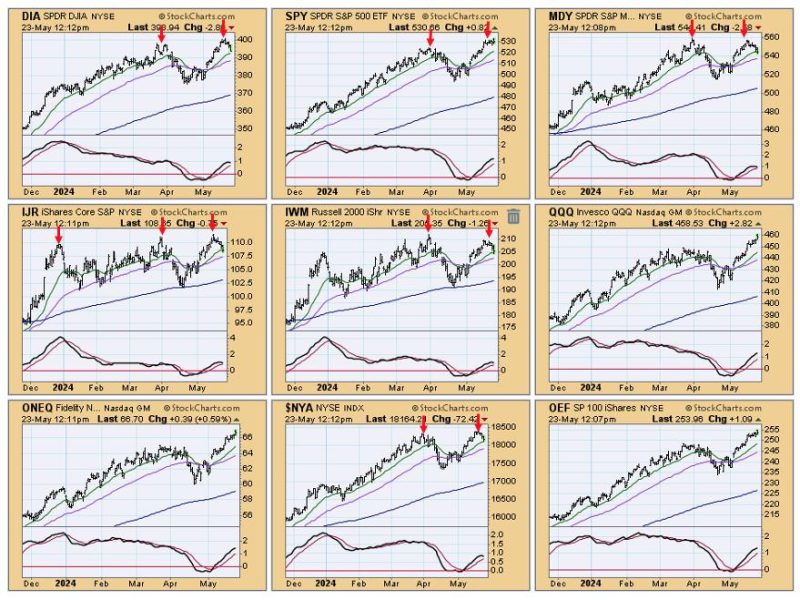

The heated debates and discussions in financial cycles revolve around whether markets are looking toppy, given the prevailing conditions. But how exactly do professionals perceive the market to be topping out? Various factors or indicators signal that the market seems to be nearing its peak.

One key indicator is the price trends. In a toppy market, an asset’s price trends upwards continuously and significantly over some time. However, in such a scenario, the dramatic, unprecedented rise in prices is often not supported by an equivalent increase in the value of the underlying company or economy, suggesting an overvaluation. When the prices outweigh the assets’ intrinsic value, it is a strong hint that the market could be topping off.

Another significant aspect is investor sentiment. In a toppy market, confidence tends to be excessively positive, accompanied by high buying activities. When investor sentiment is overly upbeat, especially without fundamental reasons, the market may be in a bubble phase and approaching its top.

Moreover, market analysts also observe the trading volumes and the volatility index as indicators for a toppy market perception. A significant rise in trading volumes without substantial reasons may suggest that the prices are artificially inflated and will not be sustained. Similarly, an increase in market volatility signals uncertainty and possible market correction.

Yet, it is essential to note that no single factor can conclusively indicate whether the market is topping out. It’s ultimately about using numerous indicators, in combination with a solid understanding of economic fundamentals and market dynamics, to make an informed decision on market trends.

Despite the hurdles, many have successfully invested in toppy markets and yielded significant returns. Savvy investors often view the overbought markets as a potential opportunity for advanced strategic planning, risk management, and return optimization.

However, it necessitates a high level of caution. Prudent market timing, selective exposure to assets, vigilant risk management, and staying informed with current market trends are the keystones to thrive in a toppy market scenario.

Altogether, understanding when the market looks toppy plays an imperative role in one’s investment planning. It encourages investors to think beyond immediate returns and conceptually understand market patterns, thereby fostering their well-informed decision-making capability. Conclusively, a toppy market should not incite fear but instead, inspire an opportunity for strategic investment planning.