Mastering Your Finances Part 3: Unleashing the Power of Relative Strength and Beyond!

Body:

Rule-based money management, particularly in investing and trading, is a strategic approach that encompasses a variety of techniques to mitigate risk and manage assets effectively. One such unorthodox but proven technique is the application of relative strength and other measures. The use of relative strength, volume analysis, and momentum indicators, among other mechanisms, can assist in effective money management and boosting investment returns.

Relative Strength (RS)

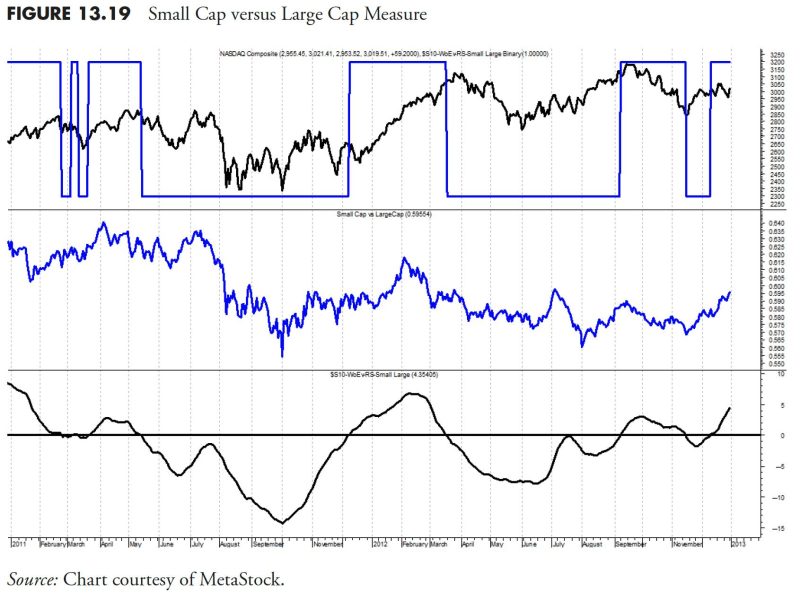

The term relative strength refers to a comparison of the performance of one investment against that of another or even an entire market index. By evaluating the difference in their respective performance, the investor can determine which investment options are likely to outperform others.

RS methodology is instrumental in pinpointing the best-performing securities and helps in minimizing risk exposure. This generates a comprehensive picture of both the present and future prospects of a particular asset in comparison to others. The key advantage of RS analysis is that it can be applied across various time frames and for a wide variety of assets.

Volume Analysis

Volume analysis is a powerful yet underutilized component of money management strategies. It involves assessing the number of shares or contracts traded in an asset or security. Surges in volume can identify potential market shifts and provide buy or sell signals.

For instance, if the price of an asset increases with high volume, it is a strong indication of a potential further increase in price, because it shows strong investor interest. In contrast, a price increase with low volume might not support a continued upward movement, as it suggests lack of interest.

Momentum Indicators

Another important tool applied in rule-based money management strategies is momentum indicators. Momentum investing involves buying securities that are trending up and selling those that appear to be trending down.

Tools like the Moving Average Convergence Divergence (MACD) highlights changes in the strength, direction, momentum, and duration of a trend in a stock’s price. The Relative Strength Index (RSI), another momentum indicator, gauges the speed and change of price movements and sends overbought or oversold signals.

Determining Entry and Exit Points

Various measures can assist traders in strategically planning their entry and exit points in the market by providing substantial price support and resistance levels. The use of Fibonacci retracement, pivot points, or trend lines can provide an insight into the ideal timing for placing trades.

Understanding Timing and Risk/Reward Ratio

Defining a trading system that helps in quantifying timing tactics and risk/reward ratio is critical in rule-based money management. A well-defined trading system pays heed to each key component involved, enabling traders to wait for the best setups and only taking meaningful high reward trades while maintaining a safe risk profile.

Establishing Stop Loss and Take Profit Levels

With rule-based money management, it is vitally important to establish stop loss and take profit levels in order to protect your investment. A stop loss order aims to limit an investor’s loss on a security position, while the take-profit order ensures that the trader does not miss out on the profit when the price trend hits a predetermined level.

By using tools and metrics such as relative strength, volume analysis, momentum indicators, and more, rule-based money management strategies offer a concrete path towards effective investment and trading decision making. Always remember, diligent planning, and strategy will go a long way in securing profitable returns and managing risk effectively.