Unmasking the Illusions of Modern Finance: Chapter 10 – A Deep Dive into Secular Markets

The Secular Market: Its Overview

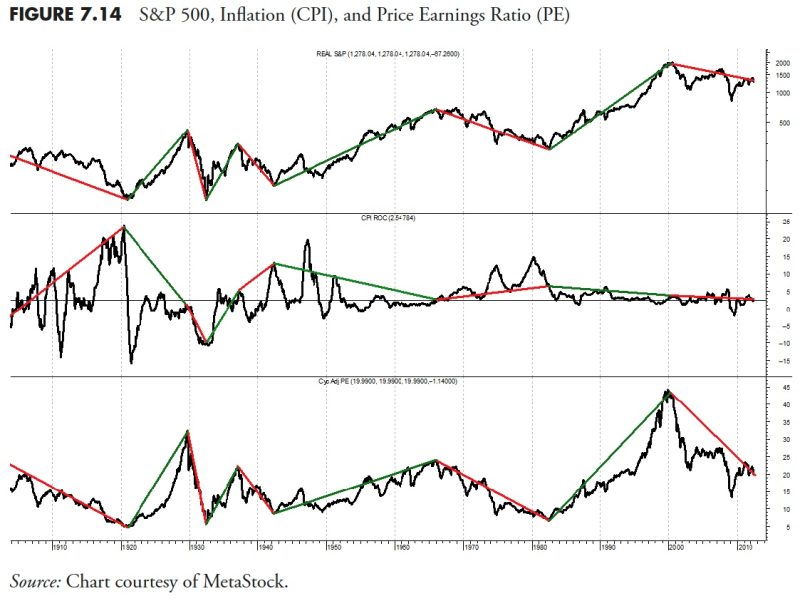

Secular markets are characterized by trends that continue for an extended period, usually over 10 years. The term secular derives from the Latin saeculum, implying long-term. The trend lines might slope upwards, downwards, or remain flat, depending on the direction the market moves. Essentially, it encapsulates the absolute movements in a market over an extended period.

Understanding the Patterns of Secular Markets

There are two primary types of secular markets: bull and bear. A secular bull market occurs when the trend is on the rise, representing sustained periods of increasing stock prices. On the contrary, a secular bear market represents a long duration of falling stock prices. The swinging pendulum between these markets usually lasts for decades, marked by periods of recovery and downturn. However, within these secular markets, there could be smaller bear and bull markets that seem to buck the prevailing trend but don’t fundamentally change the overall course.

Unmasking the Mystique: The Hoax of Modern Finance within Secular Markets

Modern finance, with its intricate algorithms and financial models, purports to predict these market movements, claiming to help investors profit from these secular trends. But is it so? One could argue it’s merely a hoax, given that it’s predicated on the notion of the ‘Efficient Market Hypothesis,’ which suggests that at any given time, prices fully reflect all available information. This is a hypothesis that has been widely challenged.

Many experts dismiss modern financial theory’s effectiveness due to its inherent flaws. Firstly, it assumes markets operate rationally, which is frequently contradicted by instances of speculative bubbles and panic selling. Secondly, it presumes that historical performance can predict future movements. However, past data is often an inefficient and unreliable predictor of future trends.

Modern finance tools, such as technical analysis or the Capital Asset Pricing Model (CAPM), indeed have their merits. They provide a systematic approach to the complex universe of investing. However, their predictions frequently fall flat against the mural of evolving market realities shaped by myriad factors beyond the grasp of algorithms and models. Economic disruptions, political upheavals, or unforeseen global events can dramatically alter market landscapes, rendering these financial theories inadequate and their predictions inaccurate.

The Impact of Irregular External Factors on Secular Markets

Secular markets, driven by longer financial cycles, are greatly influenced by fundamental factors such as changes in technology, demographic shifts in population, key political events and regulatory changes. These factors forge the long term trends over decades. However, these elements in themselves are influenced by factors outside the reach of any econometric model or financial theory, leading to the conclusion that modern finance’s ability to accurately predict these long-term trends is vastly limited.

In the face of such unpredictability, it’s essential for investors to do independent research, alongside using financial theories, and develop a comprehensive understanding of macroeconomic factors shaping the markets. Instead of relying solely on algorithms or models, integrating flexibility and intuitive judgements into investing strategies can create a more balanced and resilient approach to navigate the ebbs and flows of secular markets.

The Fallacy of Absolute Reliance

Faith in the absolute infallibility of modern finance tools can lead to an illusory sense of control, obscuring the unpredictable nature of markets and economic cycles. This is not a call to completely dismiss these tools and theories – they have their role in shaping investing strategies and bringing systemic order to investment decisions. However, understanding and appreciating the limitations of these models is essential to avoid falling prey to the hoax of modern finance.

Perfect prediction is an illusion often amplified by the pretensions of modern finance. The paradox here is that within this understanding lies the kernel to better navigate the market tides, formulating strategies that acknowledge and embrace market unpredictability. The truth within the hoax is that the market owes us nothing; it’s our responsibility to approach it with enlightenment, not misbeliefs.