Engage in the Exciting Battle Between Large-Cap and Small-Cap on RRG: A Direct Comparison!

The Relative Rotation Graphs (RRGs), developed by Julius de Kempenaer, is an innovative and superior visualization tool in the field of trading, which provides investors with a panoramic view of the relative strength of different segments within a particular market. One of the significant contrasts that traders often analyze using RRGs is the large-cap vs small-cap debate.

Understanding Large-Cap and Small-Cap Stocks

Before diving into the comparison, it is fundamental to understand what sets apart large-cap and small-cap companies. Large-cap refers to companies with a market capitalization value of more than $10 billion. These companies, often leaders in established industries, are considered less risky and provide regular dividends, making them attractive to risk-averse investors.

On the other hand, small-cap companies typically have a market capitalization value under $2 billion. They are often in growth or emerging industries, meaning they can potentially provide higher returns compared to large-cap stocks. However, this comes with a higher risk due to their instability and uncertain growth.

The Unique Perspectives of RRG

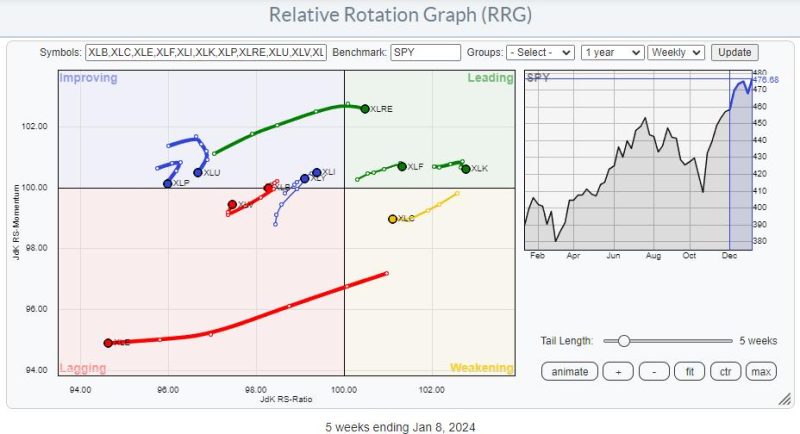

Now, when analyzing the large-cap and small-cap debate using RRG, we obtain distinctive perspectives that cannot be gleaned from traditionally linear graphs.

On an RRG chart, each plot represents a stock with its movement showing a relative performance compared to a chosen benchmark. The horizontal axis (JdK RS-Momentum) captures the momentum of the stock, while the vertical axis (JdK RS-Ratio) indicates the relative strength trends.

Interpreting Large-Cap vs Small-Cap Stocks on RRG

In an uptrending market, large-cap companies often move into the leading quadrant, indicating they are outperforming the benchmark. They have the commodities, the market reach, and the robustness to withstand market disruptions and are perceived as safe havens in shaky economies.

Contrarily, small-cap companies, due to their nascent stage, will usually be found in the improving and lagging quadrants. They frequently provide higher return potential, but with larger associated risks such as higher volatility and lower liquidity.

However, in a bull market or during economic recoveries, small-cap stocks have often shown to lead the rotations, indicating sector rotation towards riskier assets.

Incorporating RRG in Investment Strategies

RRG provides insights about a sector’s strength or weakness relative to other sectors or to a certain benchmark. This matters significantly when constructing a balanced portfolio. Depending on the investor’s risk appetite, time horizon, and market expectations, they may decide to allocate more to small-cap or large-cap stocks.

For example, risk-averse investors or retirees may prefer large-cap stocks as they are generally safer and provide steady dividends. On the other hand, aggressive investors or young people who are trying to scale their wealth might lean towards a portfolio with a stronger weighting in small-cap stocks.

In conclusion, the debate between large-cap and small-cap stocks isn’t meant to declare one as superior to the other, it is simply a matter of identifying which strategy best suits an individual’s financial goals and risk tolerance. By using innovative tools like the RRG, investors can make more informed decisions, optimizing their asset allocation strategies as per market trends and individual preferences. A prudent understanding and application of the RRG provides a considerable edge in the dynamic realm of investment and trading.