“Put/Call Panic: Weird Wednesdays Shake Up the Market!

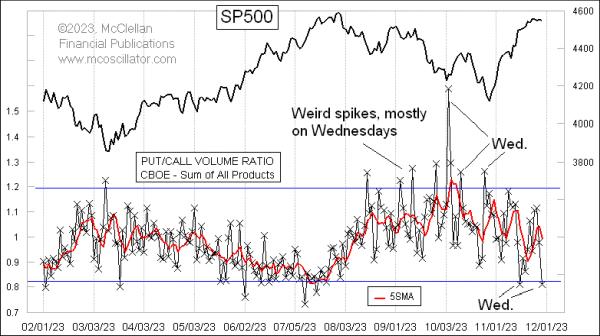

Every Wednesday, the world of stock trading gets even more interesting. Each Wednesday, investors are treated to something special known as “Weird Wednesdays.” Weird Wednesday is a unique event, during which the put/call ratio is used to gauge investor sentiment on the direction of a stock.

Put/call ratio refers to the balance between investors buying call options and put options for a particular stock. When the put/call ratio is high, it indicates that investors are bearish on the future of the stock – meaning they think that the price will go down in the near future. When the put/call ratio is low, investors are generally bullish on the stock – meaning they believe the price will go up in the near future.

During Weird Wednesdays, the put/call ratio is looked at in much more detail than usual. On Weird Wednesdays, the put/call ratio becomes the focus of investment decisions and speculators are on high alert for lucrative trading opportunities. This heightened attention to the put/call ratio allows investors to get a better handle on the current level of sentiment surrounding a stock.

Investors also watch the options market volume on Weird Wednesdays to get a better idea of the overall sentiment of a stock. If options market volume is unusually low, it can indicate that investors lack confidence in the current momentum of the stock. On the other hand, unusually high volume can indicate that the market is excited about the prospects of the stock.

Weird Wednesdays is a unique event that allows investors to gain a deeper insight into the sentiment of the stock market. By watching for the subtle shifts in investor sentiment, traders can better position themselves for success. Whether you’re a day trader or a long-term investor, Weird Wednesdays is an event you won’t want to miss.