Unlock the Potential of OPEC + Oil Cuts: Skepticism Explored

The Organization of Petroleum Exporting Countries (OPEC) has announced a recent set of cuts to oil production, in response to the crashing prices due to the global spread of COVID-19. However, some analysts are skeptical of these cuts, signaling that a potential economic rebound could be slow in order to provide stability in the market.

The international oil market has seen a dramatic drop in demand due to the sweeping restrictions brought about by the pandemic. Ongoing efforts from countries such as Saudi Arabia have allowed for a collaboration among members to lower production in order to reduce the surplus and subsequently balance the market.

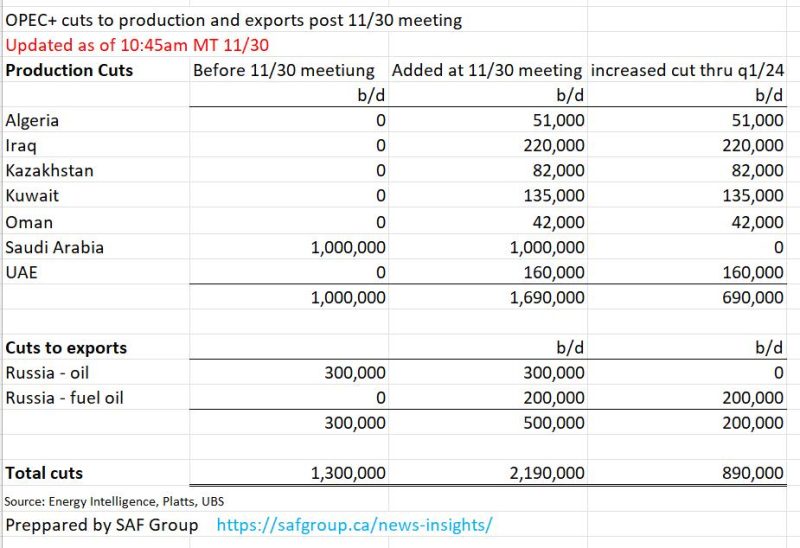

The agreements came with a promise to reduce oil production by 9.7 million barrels a day, with the cuts representing nearly 10% of the global supply. While the intent of the cuts is to stabilize the economy, critics fear that the decrease in production may fail to meet the market demand.

Furthermore, with countries such as the United States and China, among the world’s largest producers, ineligible for the agreement, the cutbacks may not be sufficient to stop the price from dropping. In fact, there is a fear that the mandated cuts may encourage U.S. producers to take advantage of the situation and increase the surplus.

In recent weeks the increase in demand has had a positive effect on prices, with oil futures rising by 10%. However, the fear still persists that the market may remain uncertain, even after the production cuts. Until the global pandemic has been brought under control, many feel that it will be hard to judge the long-term effects of the OPEC oil cuts.