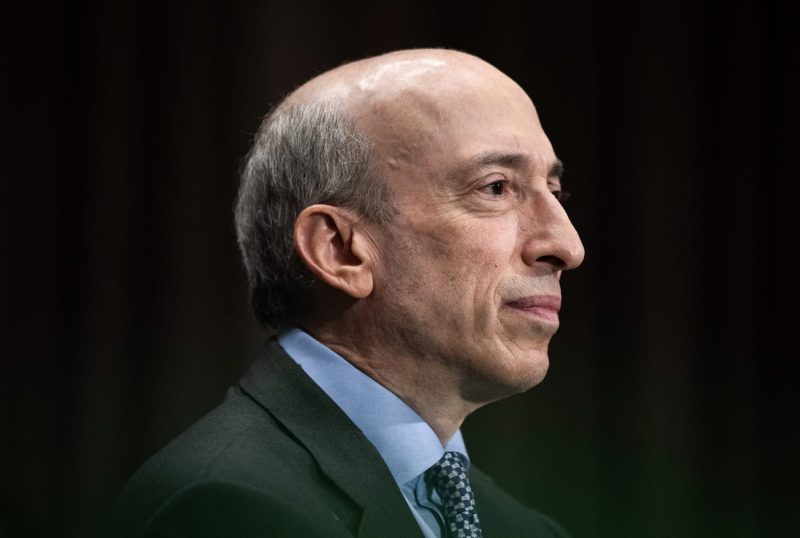

Trump’s New Era Begins: SEC Chair Gary Gensler Steps Down Jan 20th

The recent news that Gary Gensler, the current chairman of the U.S. Securities and Exchange Commission (SEC), will be stepping down from his esteemed position on January 20 has sparked much discussion and speculation regarding his successor. This imperative turning point in the American financial regulation industry will mark the end of the Gensler era and the beginning of a Trump-appointed phase.

Gary Gensler’s stint as the SEC chair, during a period of boom and turbulence in the financial markets, was marked by his efforts towards ensuring efficient functioning and transparency within the securities markets. His steadfast approach towards regulation played a crucial role in maintaining investor confidence and warding off systemic risks. A former Goldman Sachs executive and professor at MIT’s Sloan School of Management, Gensler brought a unique blend of industry experience and academic insights to his role.

Under Gensler’s watch, several regulatory changes were implemented to address the challenges posed by the rapidly evolving financial technologies. The SEC approved new rules to enhance transparency and governance for market infrastructures, significant market participants, and investment advisers. Gensler also led initiatives for improved disclosure obligations from corporations on climate risk and diversity, an issue that has gained increasing attention in corporate governance.

As the curtain closes on the Gensler era, you cannot help but wonder what tint the upcoming Trump-appointed era will bring to the canvas of the American financial regulation landscape. The tangibility of the changes that this transition might bring is unclear, but it is widely anticipated that such transition could signal a shift in the regulatory approach.

The selection of the new SEC chair will undoubtedly reveal the Trump administration’s focus and agenda. As history suggests, the ideological lean of the agency largely depends on the business and regulatory palate of the appointee. For instance, should President Trump appoint a free-market advocate as Gensler’s successor, the SEC could take a traditional Republican approach, favoring deregulation and lower corporate taxes.

Alternatively, if the successor favor stricter enforcement, as Gensler did, we could see continuity in the existing policy framework. Either way, the transition is expected to reshape the regulatory landscape, and all eyes will be on the SEC as it begins this new chapter.

Indeed, the period of transition from Gensler to the Trump replacement will be one characterized by waiting. As yet-to-be-named new SEC Chair adjusts to the reins of the commission, observers will closely follow whether the departure from Gensler’s regime will mark an era of significant policy divergence or a continuation of the existing trajectory.

In summary, Gensler’s upcoming departure from the SEC spotlight is an inflection point that signals a potential change in the regulatory approach. His successor, as chosen by the Trump administration, will undoubtedly mold the direction of the SEC in the subsequent years. While the specifics of these changes remain speculative at this juncture, the decision is likely to usher in a new era of financial regulation with potentially substantial impact on financial markets and the broader investor community. The spell of anticipation will linger within the realms of the securities market until clarity is achieved, post-January 20.