FTX Insider Betrays Sam Bankman-Fried, Receives 7.5 Years Behind Bars!

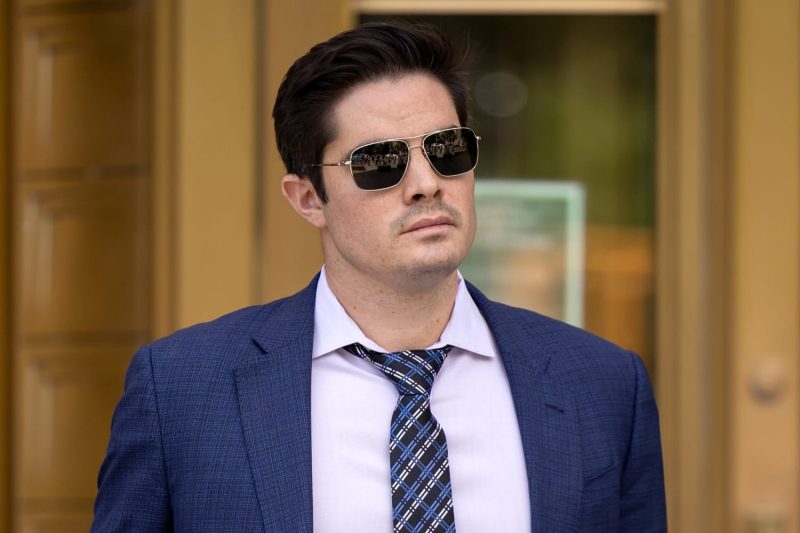

In a significant blow to the cryptocurrency industry, former FTX executive, accused of betraying the trust of FTX founder Sam Bankman-Fried, has been sentenced to 7.5 years in prison. The serious repercussions of the executive’s fraudulent actions have rippled through the digital currency sector, marking a cautionary tale about the ethical boundaries within the crypto world.

The accused, who was a star trader for the FTX Exchange, found himself at the center of a scandal with significant repercussions. His betrayal was made more shocking given that FTX Exchange, under the dynamic visionary guidance of Sam Bankman-Fried, had fast become one of the most influential trading platforms in the crypto market.

Charming his way through the ranks, the accused capitalized on his position as a top executive to manipulate internal accounts. This led to significant financial discrepancies within the FTX accounts that he was tasked to manage. He was found guilty of diverting funds amounting to millions of dollars for personal advantage, displaying audacious misuse of his position of power and trust.

Furthermore, the accused was revealed to have engaged in a plethora of unauthorized activities. He was charged with embezzlement, identity theft, perpetrating multiple illicit trades, and bypassing FTX’s KYC (Know Your Customer) protocols. This blatant violation of industry norms and ethics sparked an investigation that would eventually lead to his arrest and conviction.

Reacting to the betrayal, Sam Bankman-Fried, CEO, and founder of FTX, was aghast and disappointed. Bankman-Fried, who has built the company on a foundation of trust and innovation, found that the executive’s actions were a violation of not only company policy and expectation but also a betrayal of the ethos at FTX.

The 7.5-year sentence pronounced by the court validated this view. It was a damning indictment of the gross misconduct and violation of trust that the executive had perpetrated, sending a powerful message to industry insiders about the serious consequences of breaching ethical and professional boundaries.

What is worth noting is how the incident shaped the narrative around security norms in the crypto industry. The FTX saga drew attention to the urgent need for more rigorous security measures and internal controls to prevent such malfeasance from occurring in the first place. It helped emphasize that despite the disruptive potential of digital currencies, the need for strong safeguards, transparency, and accountability remains paramount.

In a world where cryptocurrency and digital transactions are becoming increasingly popular, the case comes as a stark reminder of the precarious line that industry insiders walk. The line between enabling innovation and ensuring that such advances don’t become opportunities for the unscrupulous to exploit is thinner than ever.

In conclusion, the episode involving the former FTX executive and Sam Bankman-Fried is more than just a scandal. It is a stark reminder of the need for trust, integrity, and credibility within the cryptocurrency landscape. It emphasizes the need for stricter compliance measures and emphasizes the importance of ethical conduct in the rapidly evolving world of digital currencies.