Value’s Reign: The Surprising 10% Stock Dip Awaits You!

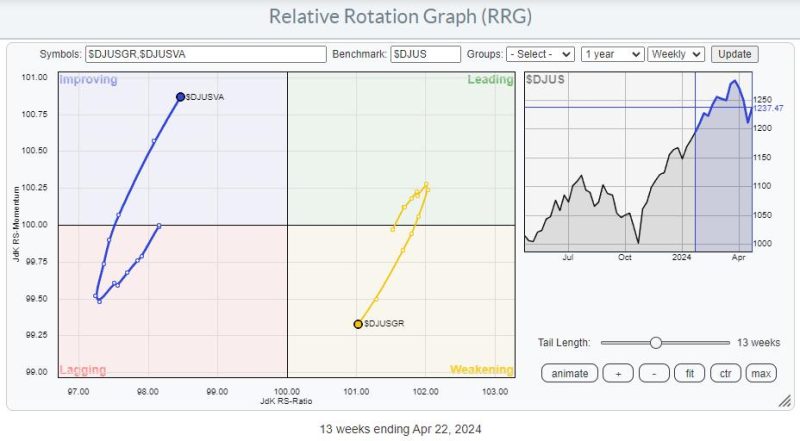

As the shift from growth to value in the stock market gains momentum, investors may need to brace themselves for potentially larger shifts in the landscape. This article will discuss the possibility of a 10% downside risk for stocks as value plays take center stage.

PERFORMANCE OF VALUE STOCKS AND DOWNWARD PRESSURE ON EQUITY PRICES

Historically, cyclical changes in the economy typically lead to a rotation from growth to value stocks. Normally, this rotation is not a matter of concern for the market at large. However, a rapid shift towards value stocks could increase the downside risk in the equity market by upwards of 10%.

In a situation where value stocks are dramatically outperforming growth stocks, the resulting shift can lead to considerable downward pressure on equity prices. This happens because the valuation multiples on growth stocks tend to contract significantly under such conditions, increasing the likelihood of a concurrent 10% downward adjustment in the overall market.

IMPACT OF ECONOMIC REOPENING ON VALUE STOCKS

In context, the reopening of economies around the world post-pandemic has spurred a rapid recovery in sectors that were previously lagging – often sectors where value stocks are predominant. These sectors include finance, energy, and certain industries within the consumer discretionary sector, to name a few. As these industries recover and regain stability, they become more attractive to investors, prompting a move away from growth stocks that were trending during the pandemic.

This phenomenon has been magnified by inflation expectations. The concept of inflation suggests a stronger economy, which typically benefits value stocks more than growth stocks. This is because value stocks tend to have a stronger performance during periods of higher economic growth and inflation.

POSSIBILITY OF INTEREST RATES INCREASING

The potential increase in interest rates is further catalyzing the move from growth to value. As interest rates rise, the future profits of growth companies become less valuable, driving down their current valuations. This causes a deflationary impact on growth stocks, triggering investors to shift their portfolios towards value stocks. Therefore, in a rising interest rate environment, value stocks typically outperform growth stocks, further increasing the downside risk for the latter.

Interestingly, while a 10% drop may seem alarming, it is not necessarily a catastrophic outcome. It’s more of a market correction rather than a crash. It’s an acknowledgment of the sector rotation from growth to value – a move that can lead to healthy investment decisions and potentially better returns in the long run. A 10% downside risk, therefore, might just be the exact impetus needed for a more balanced, diversified allocation in investors’ stock portfolios.

While predicting exact market movements are complex and rely on a multitude of factors, it is clear that the role of value stocks is becoming more prominent in the current economic climate. As such, a potential 10% downside risk in stocks should not dissuade investors, but rather drive a smarter, more strategic approach to investment decisions, with a renewed focus on value.