Industrials Vying for Leadership as Equity Markets Wrestle with Consistent Growth: April 15, 2024

The performance and fluctuations of Equity Markets often serve as a mirror reflecting the world’s economic scenario. In recent developments, the equity markets were seen struggling to maintain their Go trend as the industrial sector made a push to lead. This article aims to crunch the numbers, assess the factors at play, and reveal behind-the-scenes dynamics that are developing in the global Equity Markets as of April 15, 2024.

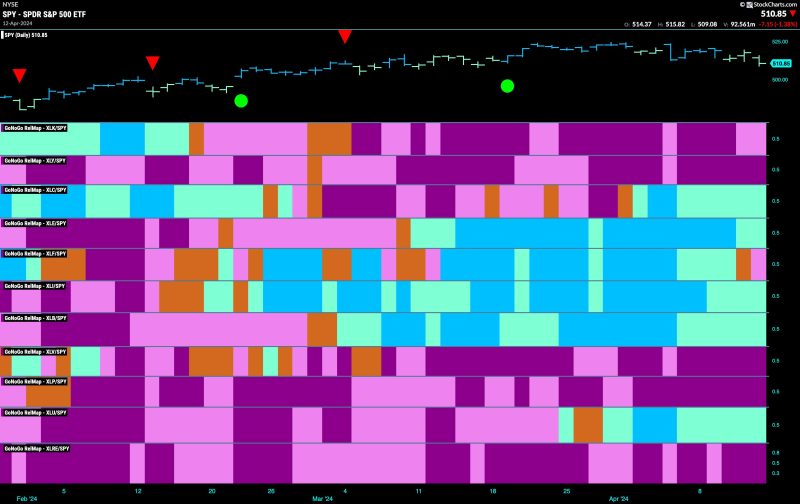

As the markets tread into the second quarter of 2024, there has been a noticeable struggle in maintaining the previously flourishing Go trend. Typically characterized by rocketing stock prices and proliferating investments, this trend has surpassed expectations over the past few years by ensuring a stable and profitable market for investors. However, recent days have seen a potential battle as the industrials sector gears up to lead, thereby creating a possible turn of tides within the equity markets.

The Industrial sectors are robust and contribute significantly towards the GDP of any economy. Their development, therefore, naturally plays a crucial role in market trends. As a consequence, the news of industrials striving to lead has been met with both curiosity and confusion, as investors and market analysts attempt to understand and predict its implications on the equity markets.

Part of the struggle to maintain the ‘Go’ trend can be linked to the impact of geopolitical tensions and the resulting uncertainty in the global market. This contributes to fluctuations in investor sentiment, which can profoundly influence market trends. The intensity of these tensions serves to undermine previously established stability in the equity market.

Furthermore, increased inflation, along with the rise of energy prices, has also played a significant role in this struggle. While these factors stimulate growth in the industrial sector, they also cause a strain on equity markets, thereby creating potential barriers to the ‘Go’ trend.

Another significant influence has been the change in government policies worldwide, with many nations focusing more on industrial development. This focus draws more investments towards the industrial sector, potentially disrupting the continuous flow towards equity markets.

However, it’s important to note that this struggle does not necessarily signify a decline or instability in equity markets. Instead, it highlights the elasticity and dynamism that characterizes these markets. Judging from past experiences, equity markets have shown remarkable resilience, navigating through economic downsides and bouncing back stronger.

The equity market’s struggle to hold onto the ‘Go’ trend amidst the industrials trying to lead is a testament to the ever-changing nature of the global financial ecosystem. It underscores the need for constant monitoring, adaptable strategies, and an informed understanding of market conditions. Therefore, while this phase presents its set of challenges and uncertainties, it also opens up new opportunities and pathways for strategic growth and high-yield investments.

In spite of the shifts and changing dynamics, it serves as a reminder to investors to maintain a diversified portfolio. It can be advantageous during these uncertain periods, helping to distribute risk while taking advantage of growth opportunities in different sectors, such as industrials.

To conclude, analyzing the struggle of equity markets in maintaining the ‘Go’ trend as industrials seek to lead paints a clear picture of the dynamic and interconnected global economy. Even as market conditions fluctuate and new leaders in the economic sector emerge, the potential for growth, development and profitable investments remains a constant – the kernel at the heart of the global equity markets.