Non-Mega Cap Tech Stocks on the Rise, Suggests RRG!

Non-Mega Cap Technology Stocks: Signs of Improvement with RRG

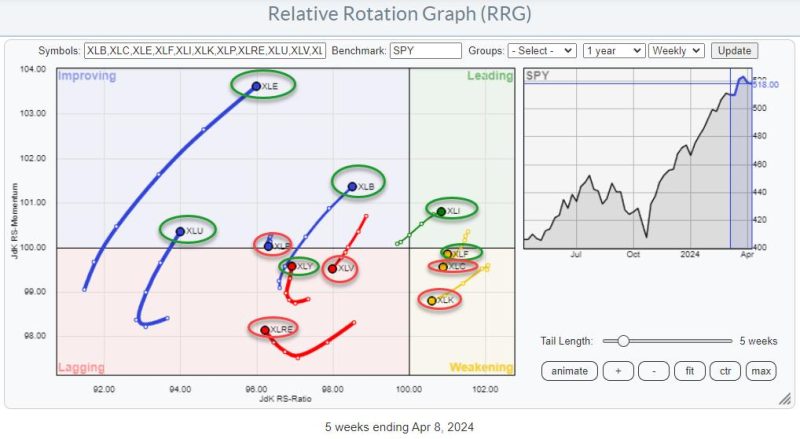

Relative Rotation Graphs (RRG), a dynamic analytical tool used primarily for gauging the performance of various sectors in the market, has recently thrown light on the progress of non-Mega cap technology stocks. It has demonstrated noteworthy improvement, implying that such stocks could be advantageous for potential investors.

To make informed investment decisions, it is crucial to consider the interplay between relative strength and momentum. In this respect, RRG stands out for its unmatched proficiency in visualizing these two key parameters simultaneously. Notably, the RRG has depicted that non-Mega cap technology stocks are moving from the ‘weakening quadrant’ to the ‘improving quadrant’, marking an uptick in relative momentum, which is a sign of potential advancement in the near future.

One of the primary reasons behind this improvement is the recent spree of innovative technological developments in the technology sector, encompassing companies beyond the Mega cap segment. Emerging technologies such as Artificial Intelligence (AI), Augmented Reality (AR), Virtual Reality (VR), and Blockchain are driving growth and profitability of these companies. As they extract the potential from these cutting-edge technologies, it reflects positively on their stocks.

Moreover, the RRG charts indicate a strong momentum for these non-Mega cap technology stocks. This can be primarily attributed to the rise in demand for tech-based services and products amid the ongoing pandemic. More enterprises are transforming digitally to cater to the virtual ways of conducting business, which has inevitably skyrocketed the need for technology-based solutions. Consequently, the technology firms offering these solutions are standing at the front line of this burgeoning progress, which is potentially the reason why RRG is indicating an upward movement of their stocks.

Furthermore, the RRG analysis, by visualizing the positional changes of these stocks on the graph, indicates that these non-Mega cap technology stocks could offer profitable opportunities to potential investors. The ‘improving quadrant’ of the graph indicates that these stocks have better relative momentum compared to some of their Mega cap counterparts. This means investing in these stocks could potentially offer better returns in the future. However, investors should conduct thorough research and consider all possible risk factors before making any investment decisions.

Historical data also concurs with RRG’s indication of improvement for these stocks. Over the past few years, despite market volatility, numerous non-Mega cap technology stocks have displayed robust growth, providing encouraging returns to investors. However, the recent RRG indications not only validate the past performance of these stocks but also shed light on their probable upward momentum in the foreseeable future.

Despite being often overshadowed by Mega cap technology stocks, it should be noted these non-Mega cap technology stocks have shown a consistent performance, especially in the last quarter. The RRG’s indication at this time offers an interesting insight for investors to diversify their portfolios by investing in these stocks, which are currently on an upward trajectory.

In conclusion, it’s noteworthy that the RRG’s translation of numerical data into visual information has played a key role in identifying the growth momentum of non-Mega cap technology stocks. These insights provide investors with a much-needed prerequisite for making informed investment decisions, ensuring a comprehensive understanding of the market dynamics at play. Therefore, those who desire to maximize their returns should look at these promising non-Mega cap technology stocks that are charting a successful trajectory and showing great potential for future growth.