BUY Signals Start to Fade: A Diminishing Trend Unfolds!

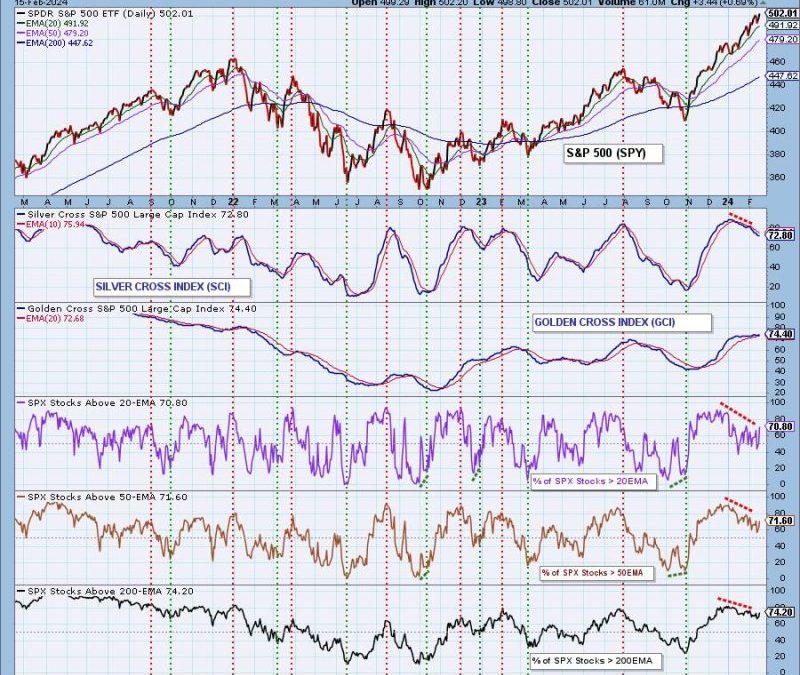

Understanding the current market trends is of utmost importance for investors and traders. One of the significant aspects of market analysis revolves around buy and sell signals. These signals help investors make decisions about the right time to buy or sell a particular security. In the recent scenario, buy signals continue to diminish, which has raised many brows in the investment sector.

A buy signal is an event or a circumstance proceeding from technical analysis that infers it is a good time to purchase a security. However, with the continual decrease in buy signals, it is becoming more challenging for buyers and investors to decide when to make a step. This decrease could attribute to many factors, ranging from individual securities’ performance to holistic market conditions.

When looking at the primary reasons for the reduction in buy signals, a shroud of economic uncertainty remains. The effect of global economic trials like political instability, national and international regulations, financial crises, and the ongoing pandemic have played their part in causing fluctuations in the securities’ market worldwide.

Another vital cause is the corporate earnings’ decline in both the real and projected scenarios. Weak corporate earnings are a sign of economic slowdown, which is not only a symptom but often a contributing factor to the diminishing buy signals. Investors are becoming cautious as a result of diminished profitability forecasts for several companies.

Interest rates and inflation are other factors impacting the diminishing buy signals. As central banks across the globe announce fluctuations in interest rates, it creates a considerable impact on the market’s trading patterns. Similarly, inflation exerts a pulling effect on buy signals since higher inflation lowers purchasing power and dent investors’ expectations.

More tangible factors like automated trading and algorithmic decisions also contribute significantly. As more institutions and individual traders lean onto algorithm-based artificial intelligence for their trading decisions, it’s impacting the conventional charting patterns and buy signals frequency.

Lastly, the shift of investor sentiment towards a risk-averse approach has also played a part in this decline. Amid uncertain times, investors often prefer to hold onto their cash rather than venture into risky investments. This prudent approach, while sensible on an individual basis, leads to an overall reduction in the generation of buy signals.

However, the diminishing buy signals does not necessarily mean a drastic disruption in market trends. Contrarily, it may offer more accurate and fewer false positives, thereby benefiting investors in making calculated decisions. This situation also underlines the importance of considering alternative indicators for evaluating investment opportunities in the ever-evolving market dynamics.

Consequently, the importance of being sensible and spreading one’s investment adequately in such times cannot be stressed enough. Moreover, leveraging the power of technical analysis can complement the waning buy signals and reinforce effective investment and trading decisions.

The recent trend of diminishing buy signals might cause initial apprehension amongst investors considering the traditional reliance on such indicators. However, it serves as a reminder that market decisions should not only depend heavily on these signals alone. Broader market indicators, fundamentals of the security, macro and micro-economic factors, and individual financial goals should be equally considered in decision-making processes.

As we navigate this financial terrain, understanding the implications of these changes and adapting to them will be vital in fostering profitable and sustainable investment strategies.